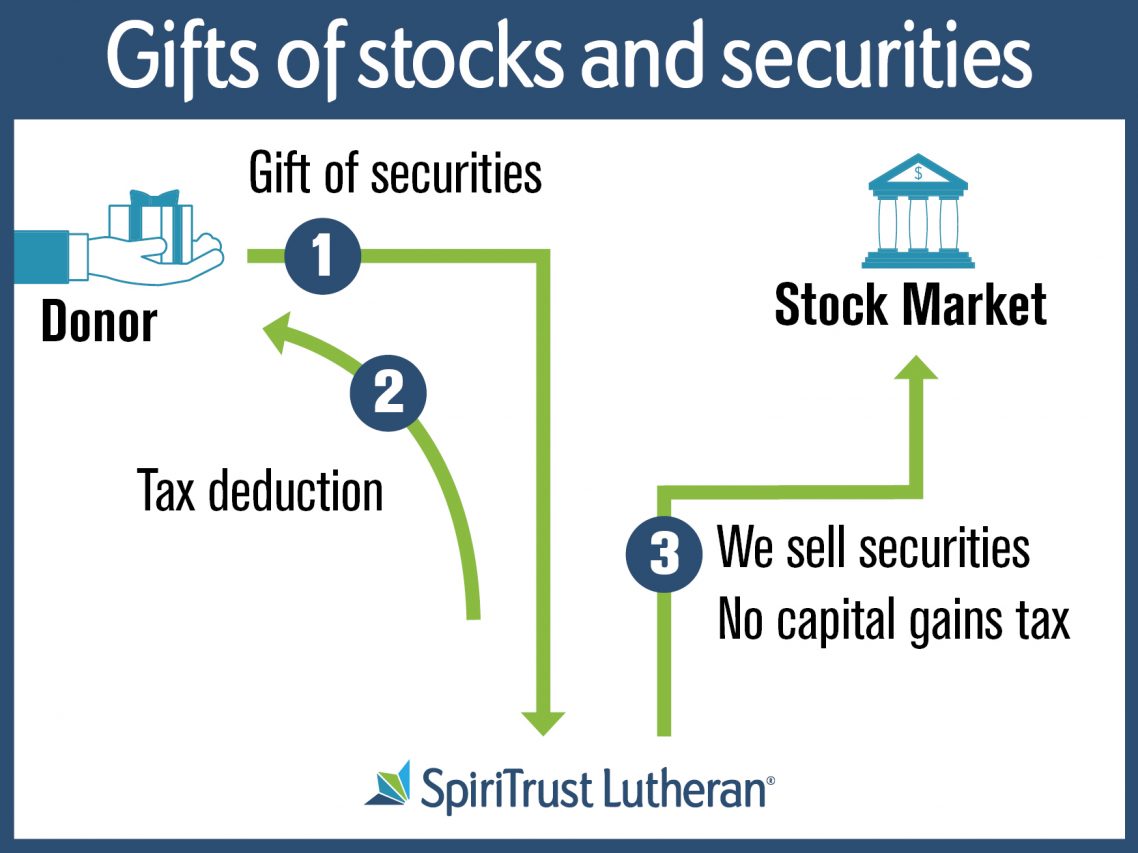

If you want to increase the impact of your gift, consider a gift of appreciated stock or other securities. When you donate securities held for one year or longer, the gift is equal to the fair market value on the date of transfer, allowing for a larger gift at a smaller out-of-pocket cost. What’s more, you pay no tax on the capital gain when SpiriTrust Lutheran® sells the asset.

For example, Joe and Susan want to make a gift of $50,000 to establish a new endowment fund. Five years ago, they purchased 1,000 shares of tech stock for $15,000 ($15 per share). Today, that same stock is valued at $50 per share. If they were to sell it, they would pay tax on $35,000 of capital gain. Instead, they decide to donate the stock to SpiriTrust Lutheran. Their out-of-pocket cost was $15,000. They save $5,250 in capital gain tax*, increasing the benefit of their donation.

*assuming they are in the 15% capital gain tax bracket.

If, however, your cost basis exceeds the current value of the stock, it may be advantageous for you to sell the shares and donate the cash. Please consult your financial advisor to determine the best strategy for your unique circumstances.